電驢下載基地 >> 图书资源 >> 經濟管理 >> 《證券分析》(Security Analysis)(Benjamin Graham & David Todd)第六版;第二版;1934年版[PDF]

| 《證券分析》(Security Analysis)(Benjamin Graham & David Todd)第六版;第二版;1934年版[PDF] | |

|---|---|

| 下載分級 | 图书资源 |

| 資源類別 | 經濟管理 |

| 發布時間 | 2017/7/11 |

| 大 小 | - |

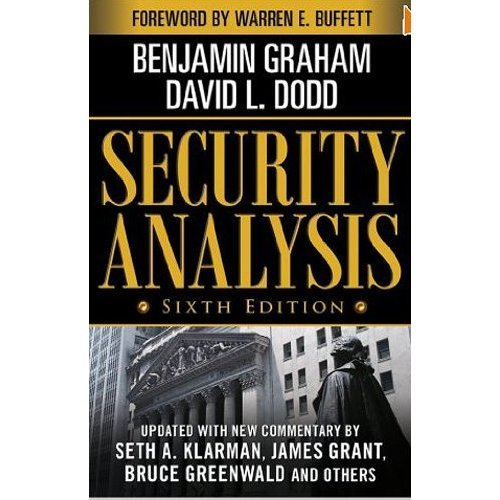

《證券分析》(Security Analysis)(Benjamin Graham & David Todd)第六版;第二版;1934年版[PDF] 簡介: 中文名 : 證券分析 原名 : Security Analysis 作者 : Benjamin Graham David Todd 資源格式 : PDF 版本 : 第六版;第二版;1934年版 出版社 : McGraw-Hill 書號 : 978-0071592536 發行時間 : 2008年09月04日 地區 : 美國 語言 : 英文 簡介 : 內容簡介:

電驢資源下載/磁力鏈接資源下載:

- 下載位址: [www.ed2k.online][證券分析].(Security.Analysis.-.6th.Edition.).Benjamin.Graham.&.David.Todd.文字版.PDF

- 下載位址: [www.ed2k.online][證券分析].(Security.Analysis.-.2th.Edition.).Benjamin.Graham.&.David.Todd.文字版.pdf

- 下載位址: [www.ed2k.online][證券分析].(Security.Analysis.-.1934.Edition.).Benjamin.Graham.&.David.Todd.掃描版.pdf

全選

"《證券分析》(Security Analysis)(Benjamin Graham & David Todd)第六版;第二版;1934年版[PDF]"介紹

中文名: 證券分析

原名: Security Analysis

作者: Benjamin Graham

David Todd

資源格式: PDF

版本: 第六版;第二版;1934年版

出版社: McGraw-Hill

書號: 978-0071592536

發行時間: 2008年09月04日

地區: 美國

語言: 英文

簡介:

內容簡介:

《證券分析》最新第六版!

華爾街經典投資著作,投資者的聖經,價值投資的必讀之作。

書中第一次闡述了尋找“物美價廉”的股票和債券的方法,這些方法在格雷厄姆去世後20年依然適用。

第六版在1940年的經典版本的基礎上,新增了200多頁來自當今華爾街最出色投資者的評論,進一步闡明了為什麼格蘭漢姆和托德的投資原則以及技巧在今天這個截然不同的市場中依然有效。同時還有了沃倫·巴菲特所撰寫的前言。

兩位師長制定的投資路線圖我已經遵循了57年,我沒有理由去尋找另外的路線了。

——沃倫·巴菲特

很多人知道三個猶太人的著作改變了世界:愛因斯坦的《相對論》改變了物理世界,弗洛伊德的《夢的解析》改變了心理世界,馬克思的《資本論》改變了人類世界。但很多人不知道,還有一個猶太人格雷厄姆的《證券分析》改變了投資世界。

——劉建位 匯添富基金首席投資理財師

中國投資者讀《證券分析》,可領悟投資真谛,告別跟風炒作。做理性投資人,迎接中國金融資本時代的到來!

——趙曉 著名經濟學家

每一位有志於投身金融界的人士都應該將最新版的《證券分析》放入必讀書單中。

——大衛·斯文森 耶魯大學首席投資官

20世紀40年代的經典之作《證券分析》經當代幾位最偉大的金融才子之手修訂後,對於今日嚴肅的投資者而言,是比以往更為必不可少的學習工具和參考書。

——傑米·戴蒙 摩根大通集團首席執行官

時至今日,《證券分析》仍然是投資者寶貴的路線圖,引領他們穿過難以預測且充滿波瀾,有時甚至是變化莫測的金融市場。

——塞思·卡拉曼 波士頓Baupost集團有限責任公司總裁、《安全邊際》作者

《證券分析》的持久價值在於格雷厄姆和多德發展出的某些重要思想,這些思想當時是,現在也依然是任何周密投資策略的基本原則。

——布魯斯·格林威爾 價值投資專家,《價值投資:從格雷厄姆到巴菲特》作者

作者簡介:

本傑明· 格雷厄姆,生於紐約市,畢業於哥倫比亞大學。華爾街上的權威人物,現代證券分析和價值投資理論的奠基人,對於許多投資界的傳奇人物,如沃倫·巴菲特、馬裡奧·加百利、約翰·乃夫、麥克·普瑞斯和約翰·伯格等都產生深遠的影響。

Benjamin Graham (May 8, 1894 – September 21, 1976)was an American economist and professional investor. Graham is considered the first proponent of Value investing, an investment approach he began teaching at Columbia Business School in 1928 and subsequently refined with David Dodd through various editions of their famous book Security Analysis. Disciples of value investing include Jean-Marie Eveillard, Warren Buffett, William J. Ruane, Irving Kahn, Hani M. Anklis, and Walter J. Schloss. Buffett, who credits Graham as grounding him with a sound intellectual investment framework, described him as the second most influential person in his life after his own father. In fact, Graham had such an overwhelming influence on his students that two of them, Buffett and Kahn, named their sons, Howard Graham Buffett and Thomas Graham Kahn, after him.

戴維·多德,格雷厄姆理論的追隨者和在哥倫比亞大學的同事,任該校金融學助教。

David LeFevre Dodd (August 23, 1895 – September 18, 1988) was an American educator, financial analyst, author, economist, professional investor, and in his student years, a protégé of, and as a postgraduate, close colleague of Benjamin Graham at Columbia Business School.

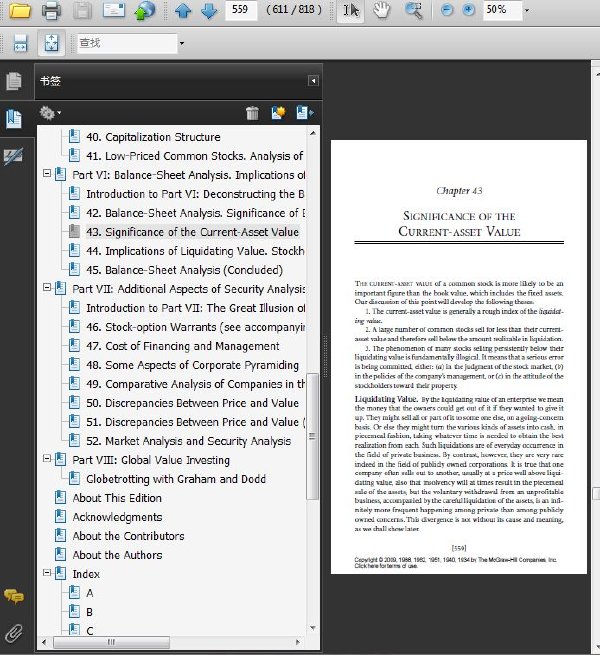

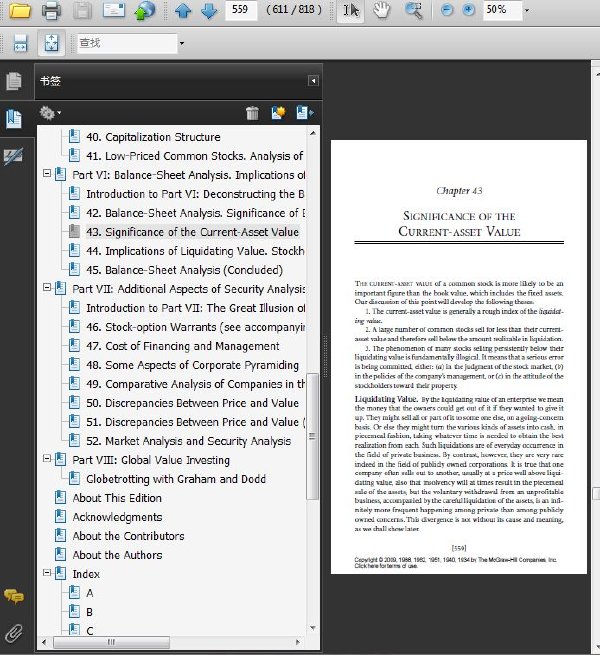

內容截圖:

目錄:

Part 1 Survey and Approach

Introduction to Part I: The Essential Lessons

1. The Scope and Limits of Security Analysis. The Concept of Intrinsic Value

2. Fundamental Elements in the Problem of Analysis. Quantitative and Qualitative Factors

3. Sources of Information

4. Distinctions Between Investment and Speculation

5. Classification of Securities

Part II: Fixed-Value Investments

Introduction to Part II: Unshackling Bonds

6. The Selection of Fixed-Value Investments

7. The Selection of Fixed-Value Investments: Second and Third Principles

8. Specific Standards for Bond Investment

10. Specific Standards for Bond Investment (Continued)

15. Technique of Selecting Preferred Stocks for Investment

16. Income Bonds and Guaranteed Securities

17. Guaranteed Securities (Continued)

18. Protective Covenants and Remedies of Senior Security Holders

19. Protective Covenants (Continued)

21. Supervision of Investment Holdings

Part III: Senior Securities with Speculative Features

Introduction to Part III: “Blood and Judgement”

22. Privileged Issues

23. Technical Characteristics of Privileged Senior Securities

24. Technical Aspects of Convertible Issues

26. Senior Securities of Questionable Safety

Part IV: Theory of Common-Stock Investment. The Dividend Factor

Introduction to Part IV: Go with the Flow

27. The Theory of Common-Stock Investment

28. Newer Canons of Common-Stock Investment

29. The Dividend Factor in Common-Stock Analysis

30. Stock Dividends (see accompanying CD for this chapter)

Part V: Analysis of the Income Account. The Earnings Factor in Common-Stock Valuation

Introduction to Part V: The Quest for Rational Investing

31. Analysis of the Income Account

32. Extraordinary Losses and Other Special Items in the Income Account

33. Misleading Artifices in the Income Account. Earnings of Subsidiaries

34. The Relation of Depreciation and Similar Charges to Earning Power

37. Significance of the Earnings Record

38. Specific Reasons for Questioning or Rejecting the Past Record

39. Price-Earnings Ratios for Common Stocks. Adjustments for Changes in Capitalization

40. Capitalization Structure

41. Low-Priced Common Stocks. Analysis of the Source of Income

Part VI: Balance-Sheet Analysis. Implications of Asset Values

Introduction to Part VI: Deconstructing the Balance Sheet

42. Balance-Sheet Analysis. Significance of Book Value

43. Significance of the Current-Asset Value

44. Implications of Liquidating Value. Stockholder-Management Relationships

45. Balance-Sheet Analysis (Concluded)

Part VII: Additional Aspects of Security Analysis. Discrepancies Between Price and Value

Introduction to Part VII: The Great Illusion of the Stock Market and the Future of Value Investing

46. Stock-option Warrants (see accompanying CD for this chapter)

47. Cost of Financing and Management

48. Some Aspects of Corporate Pyramiding

49. Comparative Analysis of Companies in the Same Field

50. Discrepancies Between Price and Value

51. Discrepancies Between Price and Value (Continued)

52. Market Analysis and Security Analysis

Part VIII: Global Value Investing

Globetrotting with Graham and Dodd

原名: Security Analysis

作者: Benjamin Graham

David Todd

資源格式: PDF

版本: 第六版;第二版;1934年版

出版社: McGraw-Hill

書號: 978-0071592536

發行時間: 2008年09月04日

地區: 美國

語言: 英文

簡介:

內容簡介:

《證券分析》最新第六版!

華爾街經典投資著作,投資者的聖經,價值投資的必讀之作。

書中第一次闡述了尋找“物美價廉”的股票和債券的方法,這些方法在格雷厄姆去世後20年依然適用。

第六版在1940年的經典版本的基礎上,新增了200多頁來自當今華爾街最出色投資者的評論,進一步闡明了為什麼格蘭漢姆和托德的投資原則以及技巧在今天這個截然不同的市場中依然有效。同時還有了沃倫·巴菲特所撰寫的前言。

兩位師長制定的投資路線圖我已經遵循了57年,我沒有理由去尋找另外的路線了。

——沃倫·巴菲特

很多人知道三個猶太人的著作改變了世界:愛因斯坦的《相對論》改變了物理世界,弗洛伊德的《夢的解析》改變了心理世界,馬克思的《資本論》改變了人類世界。但很多人不知道,還有一個猶太人格雷厄姆的《證券分析》改變了投資世界。

——劉建位 匯添富基金首席投資理財師

中國投資者讀《證券分析》,可領悟投資真谛,告別跟風炒作。做理性投資人,迎接中國金融資本時代的到來!

——趙曉 著名經濟學家

每一位有志於投身金融界的人士都應該將最新版的《證券分析》放入必讀書單中。

——大衛·斯文森 耶魯大學首席投資官

20世紀40年代的經典之作《證券分析》經當代幾位最偉大的金融才子之手修訂後,對於今日嚴肅的投資者而言,是比以往更為必不可少的學習工具和參考書。

——傑米·戴蒙 摩根大通集團首席執行官

時至今日,《證券分析》仍然是投資者寶貴的路線圖,引領他們穿過難以預測且充滿波瀾,有時甚至是變化莫測的金融市場。

——塞思·卡拉曼 波士頓Baupost集團有限責任公司總裁、《安全邊際》作者

《證券分析》的持久價值在於格雷厄姆和多德發展出的某些重要思想,這些思想當時是,現在也依然是任何周密投資策略的基本原則。

——布魯斯·格林威爾 價值投資專家,《價值投資:從格雷厄姆到巴菲特》作者

作者簡介:

本傑明· 格雷厄姆,生於紐約市,畢業於哥倫比亞大學。華爾街上的權威人物,現代證券分析和價值投資理論的奠基人,對於許多投資界的傳奇人物,如沃倫·巴菲特、馬裡奧·加百利、約翰·乃夫、麥克·普瑞斯和約翰·伯格等都產生深遠的影響。

Benjamin Graham (May 8, 1894 – September 21, 1976)was an American economist and professional investor. Graham is considered the first proponent of Value investing, an investment approach he began teaching at Columbia Business School in 1928 and subsequently refined with David Dodd through various editions of their famous book Security Analysis. Disciples of value investing include Jean-Marie Eveillard, Warren Buffett, William J. Ruane, Irving Kahn, Hani M. Anklis, and Walter J. Schloss. Buffett, who credits Graham as grounding him with a sound intellectual investment framework, described him as the second most influential person in his life after his own father. In fact, Graham had such an overwhelming influence on his students that two of them, Buffett and Kahn, named their sons, Howard Graham Buffett and Thomas Graham Kahn, after him.

戴維·多德,格雷厄姆理論的追隨者和在哥倫比亞大學的同事,任該校金融學助教。

David LeFevre Dodd (August 23, 1895 – September 18, 1988) was an American educator, financial analyst, author, economist, professional investor, and in his student years, a protégé of, and as a postgraduate, close colleague of Benjamin Graham at Columbia Business School.

內容截圖:

目錄:

Part 1 Survey and Approach

Introduction to Part I: The Essential Lessons

1. The Scope and Limits of Security Analysis. The Concept of Intrinsic Value

2. Fundamental Elements in the Problem of Analysis. Quantitative and Qualitative Factors

3. Sources of Information

4. Distinctions Between Investment and Speculation

5. Classification of Securities

Part II: Fixed-Value Investments

Introduction to Part II: Unshackling Bonds

6. The Selection of Fixed-Value Investments

7. The Selection of Fixed-Value Investments: Second and Third Principles

8. Specific Standards for Bond Investment

10. Specific Standards for Bond Investment (Continued)

15. Technique of Selecting Preferred Stocks for Investment

16. Income Bonds and Guaranteed Securities

17. Guaranteed Securities (Continued)

18. Protective Covenants and Remedies of Senior Security Holders

19. Protective Covenants (Continued)

21. Supervision of Investment Holdings

Part III: Senior Securities with Speculative Features

Introduction to Part III: “Blood and Judgement”

22. Privileged Issues

23. Technical Characteristics of Privileged Senior Securities

24. Technical Aspects of Convertible Issues

26. Senior Securities of Questionable Safety

Part IV: Theory of Common-Stock Investment. The Dividend Factor

Introduction to Part IV: Go with the Flow

27. The Theory of Common-Stock Investment

28. Newer Canons of Common-Stock Investment

29. The Dividend Factor in Common-Stock Analysis

30. Stock Dividends (see accompanying CD for this chapter)

Part V: Analysis of the Income Account. The Earnings Factor in Common-Stock Valuation

Introduction to Part V: The Quest for Rational Investing

31. Analysis of the Income Account

32. Extraordinary Losses and Other Special Items in the Income Account

33. Misleading Artifices in the Income Account. Earnings of Subsidiaries

34. The Relation of Depreciation and Similar Charges to Earning Power

37. Significance of the Earnings Record

38. Specific Reasons for Questioning or Rejecting the Past Record

39. Price-Earnings Ratios for Common Stocks. Adjustments for Changes in Capitalization

40. Capitalization Structure

41. Low-Priced Common Stocks. Analysis of the Source of Income

Part VI: Balance-Sheet Analysis. Implications of Asset Values

Introduction to Part VI: Deconstructing the Balance Sheet

42. Balance-Sheet Analysis. Significance of Book Value

43. Significance of the Current-Asset Value

44. Implications of Liquidating Value. Stockholder-Management Relationships

45. Balance-Sheet Analysis (Concluded)

Part VII: Additional Aspects of Security Analysis. Discrepancies Between Price and Value

Introduction to Part VII: The Great Illusion of the Stock Market and the Future of Value Investing

46. Stock-option Warrants (see accompanying CD for this chapter)

47. Cost of Financing and Management

48. Some Aspects of Corporate Pyramiding

49. Comparative Analysis of Companies in the Same Field

50. Discrepancies Between Price and Value

51. Discrepancies Between Price and Value (Continued)

52. Market Analysis and Security Analysis

Part VIII: Global Value Investing

Globetrotting with Graham and Dodd

相關資源:

- [經濟管理]《財富是怎樣產生的 》(陳志武)掃描版[PDF]

- [人文社科]《疾風迅雷——杉浦康平雜志設計的半個世紀》掃描版[PDF]

- [生活圖書]《內經知要淺解》掃描版[PDF]

- [文學圖書]《《讀者》十年精品集》掃描版[PDF]

- [教育科技]《數碼服裝設計實例教程 設計篇 一》掃描版

- [其他圖書]《誰說菜鳥不會數據分析(工具篇)》影印版[PDF]

- [文學圖書]《曹操》(陳舜臣)掃描版[PDF]

- [文學圖書]《2008年我最喜愛的中國散文100篇》掃描版[PDF]

- [人文社科]《偷心大少》(Dirty Rotten Scoundrels)思路.xvid.dd51[HDTV-RE]

- [人文社科]《歷代箴銘選讀》掃描版[PDF]

- [其他圖書]《500個項目入選世界建築圖集》(500個項目入選世界建築圖集)影印版[PDF]

- [文學圖書]《中國傳統文化精粹:古詩選》(黃醒亞)掃描版[PDF]

- [人文社科]《他者的歷史:社會人類學與歷史制作》清晰掃

- [其他圖書]《1000多個圖形元素,獨特的設計元素》(1000

- [教育科技]《結婚與婚姻無效糾紛的處置》掃描版[PDF]

- [生活圖書]《球類折紙》(Ball Origami)影印版[PDF]

- [行業軟件]《word模板批量加載壓縮工具》(word tool)1.0[壓縮包]

- [文學圖書]《皇城春秋》(劉建斌)掃描版[PDF]

- [計算機與網絡]《琢石成器:Windows下32位匯編語言程序設計(第

- [游戲綜合]《龍珠:超宇宙》(Dragon Ball: Xenoverse)免安裝硬盤版

免責聲明:本網站內容收集於互聯網,本站不承擔任何由於內容的合法性及健康性所引起的爭議和法律責任。如果侵犯了你的權益,請通知我們,我們會及時刪除相關內容,謝謝合作! 聯系信箱:[email protected]

Copyright © 電驢下載基地 All Rights Reserved